Interest rates are at inconceivable levels

8 Charts of the Markets

Interest rates are at inconceivable levels

Should you be paying a bank to hold your money?

In this newsletter we will investigate the worldwide phenomenon of low / negative interest rates and their effect on your investments and lifestyle.

Earlier this week, the U.S. Treasury 10-Year Yield reached a record all-time low of 1.32%. Investors in U.S. Treasuries bonds (0-10 years’ maturity) are now losing money when adjusting for inflation. Comparatively, U.S. stocks currently yield around 2% in dividends annually.

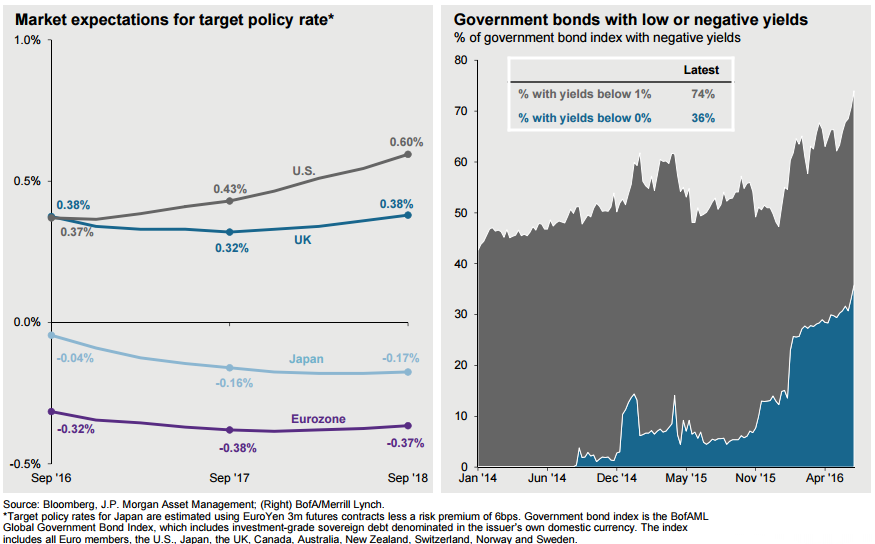

The phenomenon of low rates has been even more exaggerated in Europe than in the United States. Germany, Switzerland, Denmark, Sweden all currently have negative interest rates. Essentially, investors in these countries may be forced to pay cash just to hold money in the bank. In the most extreme of these cases, the Swiss 3-month Libor rate was at -0.8% as of late June! We also saw record-lows in France and U.K.

History

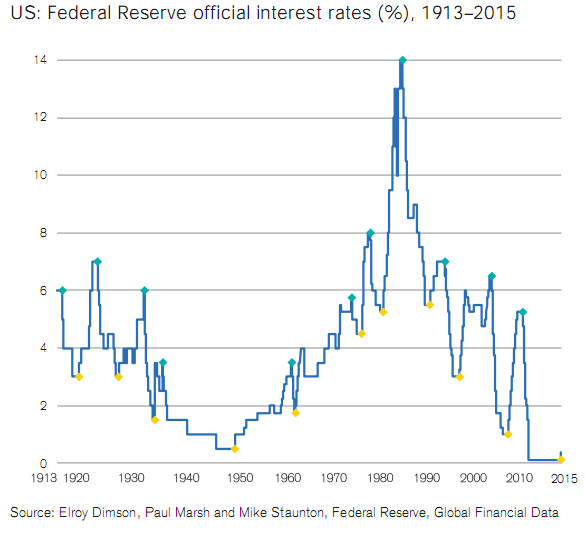

Let’s give some historical context to how insanely interest rates have fallen in the past few years. Before 2012, the 10-Year Treasury Yield had not dipped below 2% since the 1940s.

Do you remember the multi-decades bond bear market that ended in 1981? Yields always went up. For the last 35 years, yields have been going down!

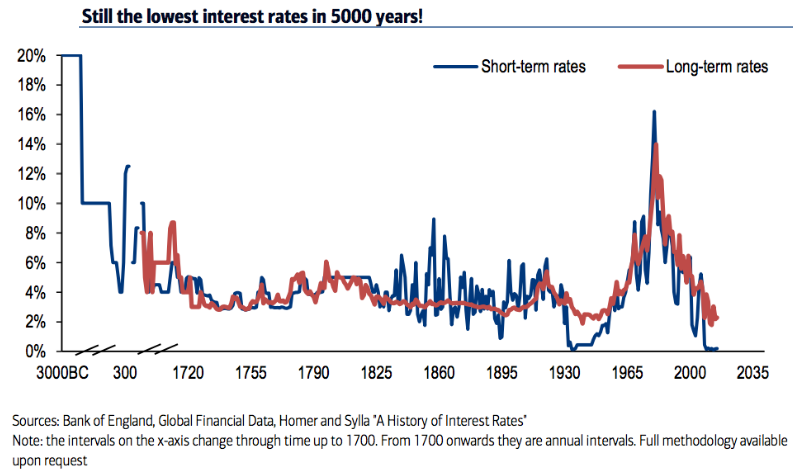

Stepping further back into history, you can see below 5,000 years of lending and borrowing at positive rates of interest (except for the U.S. Treasury bill rates in the 1930’s). Is the world economy in its worst condition since 3000 B.C.?

A World Turned Upside Down

Until a few years ago, hardly anyone in the financial world believed that negative interest rates were possible. Now they are widespread. Today, 36% of all governments bonds in the world have a negative yield. On the chart below on the right you can see that investors lend money to governments and don’t get their full capital back! As you can see below on the left, the financial markets expect low or negative interest rates until 2019. Are we in a secular stagnation?

Why are Yields so low?

The question then turns to why interest rates have fallen to the lowest levels in millennia. Monetary policy and investor uncertainty play a big role in explaining record low rates.

Monetary Policy

The past few years have seen an explosion in the use of monetary policy by central banks as an instrument of economic course correcting. When central banks want to help economies grow, they take actions such as reducing the interest rates they charge on loans to banks or, more recently, buying assets (“quantitative easing”).

In theory, both of these will add to the funds in circulation and encourage economic activity. The lower rates are, and the more money there is in circulation, the more likely people and businesses will be to borrow, spend and invest. These things will make the economy more vibrant.

Extreme monetary policy is really a big economic experiment and who knows how it will end... The consequence in the short term however is interest rates are far below their natural levels.

Flight to Safety

U.S. Treasuries in particular have been driven to lower yields as they have been perceived to be a safe asset by foreign investors. A faltering Eurozone, doubts about the Chinese economy and most recently the "Brexit" has led to an influx in foreign capital into relatively safe U.S. bond markets (and pushed the Pound Sterling to a fresh 31-year low). Accordingly, U.S. bonds yields went lower as a result of this demand.

Conclusions

What are the effects of low interest rates and treasury yields on your investments and financial future?

Bonds are expensive

Record low rates suggest it is not the best time to be overweight bonds. While it may seem counter intuitive, low yields imply higher prices for bonds.

Downside risk

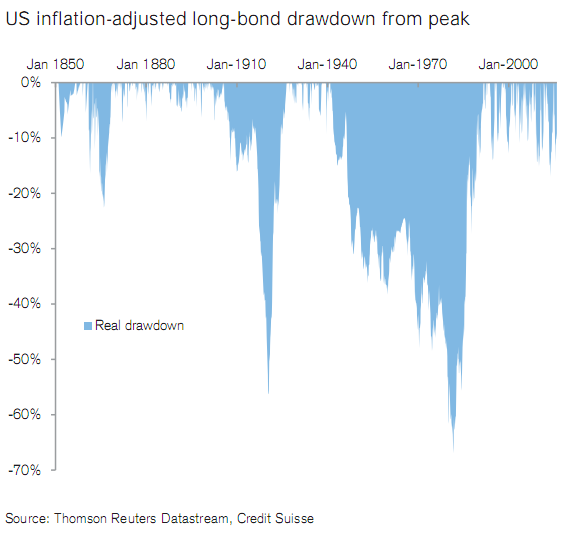

During the last bear bond market from 1940 to 1981, an investor in long term bonds may have lost (adjusted for inflation) more than 60%. Bonds are not a risk free asset.

Low yields make retirement more difficult

Most retirement investment accounts have significant allocation to bonds. Bonds are considered less risky investment than equities because their cash flows are more certain (annual coupons and payout at maturity). The lower than expected future bond performance can derail investment returns needed for a planned retirement.

>> Discuss your asset allocation with your financial advisor to ensure your investments are on track to satisfy your retirement goals.

Appendix

The chart below shows the great performance (rolling 3-year total return) that investors in U.S. Bonds (Barclays US Aggregate Bond index) have enjoyed for the last 35 years. It was 4.5% as of 06/30/2016.

Today, many investors only expect around 2% (before taxes and inflation) for the next 5-10 years.

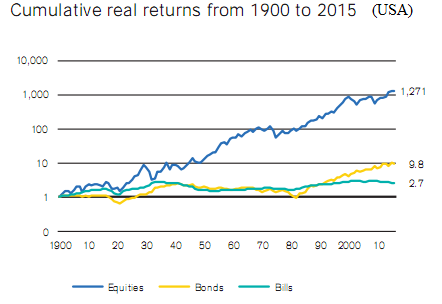

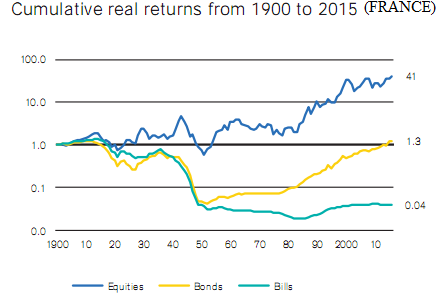

The two charts below shows the growth (adjusted for inflation) of $1 in stocks/equities, bonds/fixed income, and cash/bills in the U.S.A. and in France since 1900.

If you are interested in more charts and good articles to improve your financial decisions, check out our daily postings at

www.tinyurl.com/BFM-Facebook

or our blog at

www.bourbonfm.com/blog.

This market commentary expresses BFM’s views as of July, 2016 and should not be relied on as research or investment advice regarding any investment.

This newsletter was first published in July of 2016

https://us4.campaign-archive.com/?u=573d134676472fe56336c7f4f&id=ff051117a0&e=5afe035835